The UK economy grew by just 0.1% in the final quarter of last year, missing market expectations of 0.2% and ending 2025 on a notably weak footing. This morning’s data comes after a difficult week for the pound following the negativity surrounding domestic politics. Later in the day, focus shifts to the US and Europe, several key data points could dictate the afternoon’s volatility. At 1:30pm, the US will release…

Read MoreWhat is the Cost of Public Sector Pensions?

This is a question that seems to be growing in importance in discussions about Public finances. Is the system of pension arrangements provided to the Public Sector employees fair when compared to that in the Private Sector, or is there ‘pensions apartheid’? As it turns out, the Office for Budget of Responsibility (OBR) think, as a country, there is a ‘surplus’. Is this a case of ‘robbing Peter to pay…

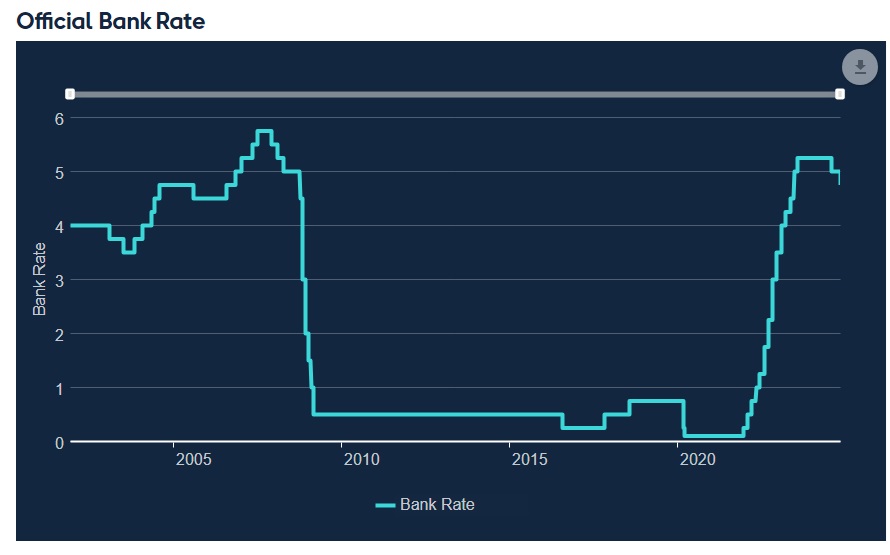

Read MoreBoE UK Interest Rate Decision

7 November 2024 What happened? In the wake of the significant developments we have seen for fiscal and monetary policy at home (the UK budget) and abroad (the US election) over the past few weeks, the Bank of England (BoE) remained on course today with the second 25 basis point (bp) cut of this easing cycle. As widely anticipated, the bank rate now stands at 4.75%, down from 5.00%. The…

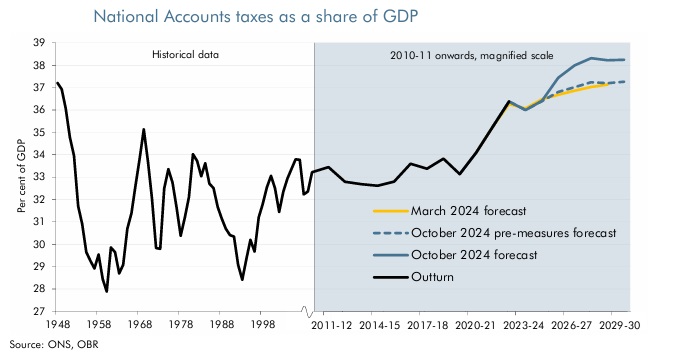

Read MoreAutumn Budget 2024

“Our mission to grow the economy” Chancellor of the Exchequer, Rachel Reeves, delivered the Labour government’s first Budget on 30 October with a promise to “restore economic stability” and “invest, invest, invest” to promote growth. In her statement, she outlined a number of new tax and spending measures that she said would create “an economy that is growing, creating wealth and opportunity for all.” In total, the Budget will see…

Read MoreHow do you find a lost pension?

If you’re not close to retirement, you may think there’s no rush to find your old pensions. But the sooner you sort it out, the better. Without the details of your pensions you won’t know how your money is being invested, or what you’re paying in fees. Both can make a big difference to how the amount you’ve paid in could grow over the years. By finding that pension you…

Read MoreAutumn Budget 2024 – Preview

With Labour’s inaugural Budget taking place on 30 October, Chancellor Rachel Reeves has set the tone by cautioning that “difficult decisions” need to be made on key areas such as spending, tax and welfare. With an apparent GBP22bn “black hole” in the public finances, speculation is mounting over the taxes the Chancellor may choose to amend to plug the gap. We already know that school fees have been targeted, with…

Read MoreWhat to do During Periods of Market Turbulence

Large market swings can be unsettling for some, particularly when their portfolios are losing value. Moving portfolios into cash during times of turbulence can often lead to lower long-term returns than simply staying invested. These visual aids can help reassure you to stay the course and maintain a long-term focus when markets are volatile. Don’t let turbulence distract you. Keep your focus on the longer term Short-term volatility is a…

Read MoreSpring 2024 Budget

On 6 March, Chancellor of the Exchequer Jeremy Hunt delivered his Spring Budget to the House of Commons declaring it was “a Budget for long-term growth.” The fiscal update included a number of new policy measures, such as a widely-anticipated reduction in National Insurance, abolition of the non-dom tax status and new savings products designed to encourage more people to invest in UK assets. The Chancellor said his policies would…

Read MoreHow to Protect Your Online ‘Estate’

Most people understand the concept of having, or already have in place, a Will. In their Will they will leave instructions on how they want their assets distributed. Technology and social practices have changed hugely in recent years, and so when thinking about your Will, new factors should be taken into consideration. For example, many people now bank almost exclusively online. Payments for goods and services have moved from cash,…

Read More‘Benefits-in-Kind’ for the Small Business Owner

Is the business you run really providing you with all the benefits it could?

Read More