7 November 2024

What happened?

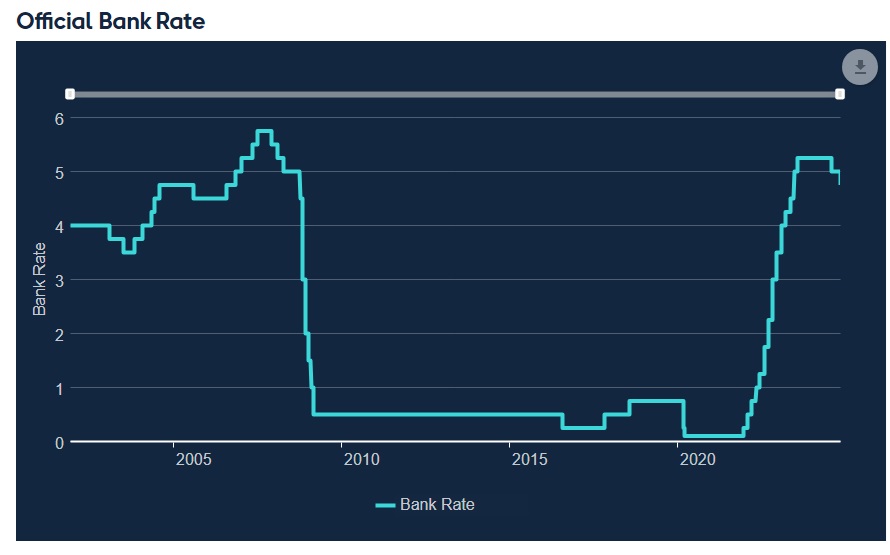

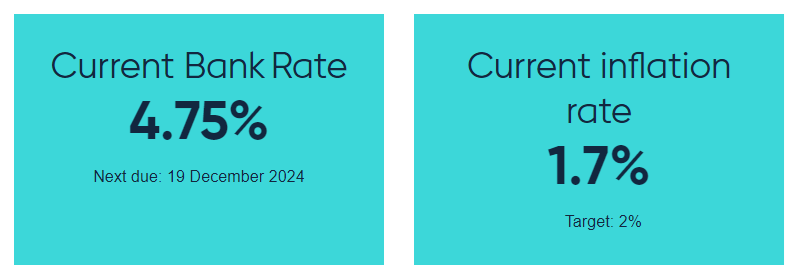

In the wake of the significant developments we have seen for fiscal and monetary policy at home (the UK budget) and abroad (the US election) over the past few weeks, the Bank of England (BoE) remained on course today with the second 25 basis point (bp) cut of this easing cycle. As widely anticipated, the bank rate now stands at 4.75%, down from 5.00%.

The vote was split 8-1, with Catherine Mann the sole hawk, as expected.

What does it mean?

Arguably the most interesting aspect of today’s meeting was the update to the Bank’s forecasts following the loosening of the fiscal stance versus the August projections and colour as to their read of what it may mean for the health of the UK economy.

‘The combined effects of the measures announced in Autumn Budget 2024 are provisionally expected to boost the level of GDP by around ¾% at their peak in a year’s time, relative to the August projections. The Budget is provisionally expected to boost CPI inflation by just under ½ of a percentage point at the peak, reflecting both the indirect effects of the smaller margin of excess supply and direct impacts from the Budget measures.’

Recent data in the UK reflected progress on the inflation front with CPI, core CPI and the ‘sticky’ services component coming at 1.7%, 3.2% and 4.9%, all lower than the 1.9%, 3.4% and 5.2% expected. The Monetary Policy Committee (MPC) flagged that it expected it ‘to increase to around 2.5% by the end of the year as weakness in energy prices falls out of the annual comparison’. In the medium-term CPI is expected to fall to the 2% with their base case potentially needing a ‘a period of economic slack’ to offset second-round effects of the budget in domestic prices and wages.

If the Bank Rate changes, then normally retail banks change their interest rates on saving and borrowing. But the Bank Rate isn’t the only thing that affects interest rates on saving and borrowing.

Interest rates can change for other reasons and may not change by the same amount as the change in the Bank Rate. To cover their costs, banks need to pay less on saving than they make on lending. But they can’t pay less than 0% on savings or people might not deposit any money with them.

This means that when the Bank Rate comes close to 0%, how far banks pass it on to lower saving and borrowing rates reduces. And as the Bank Rate starts to rise away from close to 0%, that’s likely to lead to less of a rise in saving and borrowing rates.

A change in the Bank Rate affects how much people spend. And how much people spend overall influences how much things cost. So if there is a change in the Bank Rate this can influence prices and inflation.

If rates fall and you have a loan or mortgage, your interest payments may get cheaper. And, if you have savings, you may be paid less interest. If interest rates fall, it’s cheaper for households and businesses to increase the amount they borrow but it’s less rewarding to save.

Lower rates also tend to increase the value of wealth, such as people’s pensions or housing, compared to what they would have been.

The Bottom Line

The BoE lowered interest rates to 4.75%. As per their previous rhetoric, I expect them to continue to emphasise their data dependence meeting-by-meeting. After the UK Budget, the market is now pricing a further 25bps cut over the next year.